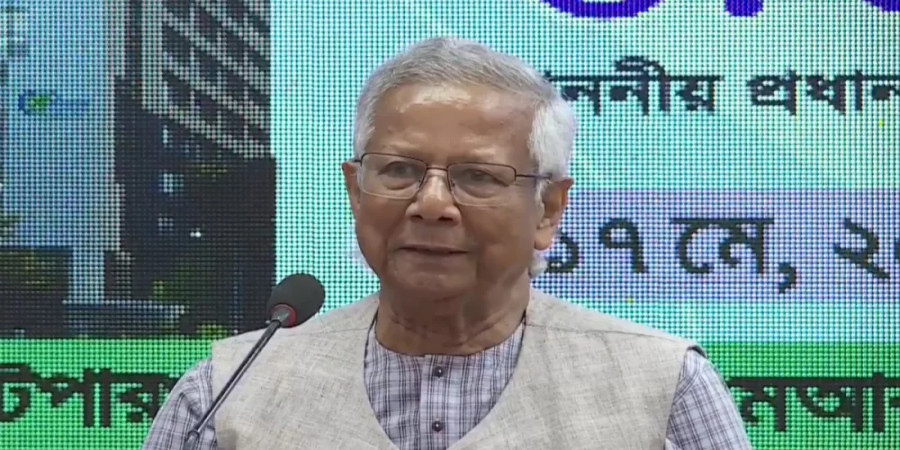

ছবি: Photo: Collected

Chief Adviser Dr. Muhammad Yunus has called for the formulation of a separate law to establish microcredit banks, arguing that keeping microcredit under the umbrella of NGOs will not bring the institutional character required for effective banking. Speaking on Saturday, May 17, at the inauguration ceremony of the Microcredit Regulatory Authority (MRA) building in Agargaon, Dhaka, Dr. Yunus expressed that the current framework limits the potential of microcredit institutions and hinders their transformation into fully functional banks.

Dr. Yunus stated that statistical observations reveal a significant limitation in the current structure of microcredit institutions: while they are permitted to accept savings from their own members, they cannot receive deposits from external individuals. This restriction, he argued, is a barrier to their growth and sustainability. Therefore, he urged the government and relevant stakeholders to introduce a specific law that would enable the creation of microcredit banks with well-defined operational boundaries.

He emphasized that such institutions must be legally recognized as social enterprises, designed to serve communities rather than generate profit. The legal framework should clearly stipulate that microcredit banks will not operate as traditional profit-driven commercial banks. According to him, the Grameen Bank stands as a model example, which can guide the transformation. He assured that Grameen Bank would be ready to support other institutions by providing necessary tools and knowledge, helping them evolve into authentic microcredit banks. He expressed optimism that such development would shift people's reliance away from conventional employment, as they would be empowered through access to community-based financial services.

In his speech, Dr. Yunus strongly defended the status and integrity of Grameen Bank, describing it as a genuine bank unlike many others in the country that, in his words, only appear to be banks in form. He pointed out that the foundation of Grameen Bank lies in trust, eliminating the need for collateral – a feature he noted as missing in conventional banking systems. He criticized modern banking institutions for losing their human-centric values and argued that most of them no longer represent true banking services.

Dr. Yunus claimed that many traditional banks have already become obsolete or ineffective, whereas Grameen Bank remains vibrant and operational. The sustainability and resilience of Grameen Bank, according to him, come from its deep-rooted connection with people’s identities and trust.

He concluded by asserting that the model of banking represented by Grameen Bank is the future of financial services. In his vision, microcredit banks based on trust, community engagement, and social enterprise principles will pave the way for a more inclusive and sustainable banking system in the days ahead.

repoter