ছবি: Photo: Collected

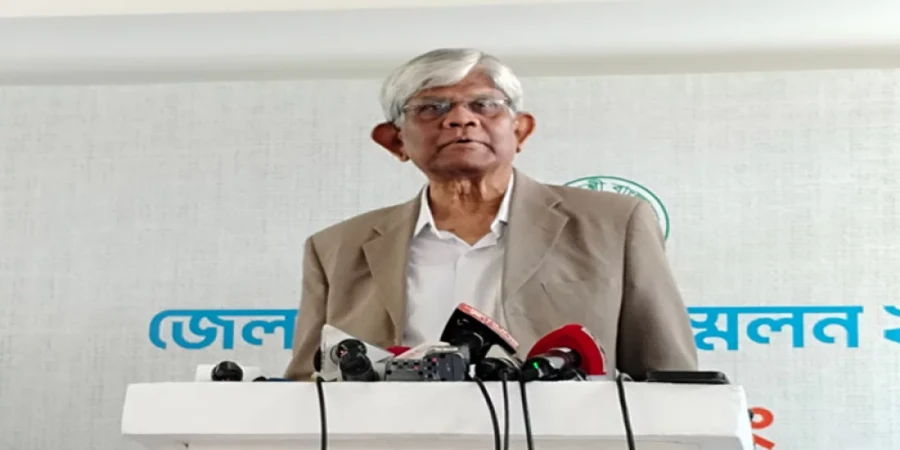

The government is set to bring rural doctors, businesspersons, and lawyers under the tax net, ensuring their fees are processed through digital payment methods to enhance transparency. Dr. Salehuddin Ahmed, Advisor to the Ministry of Finance, confirmed this directive, emphasizing that many professionals in rural areas earn substantial income but do not pay taxes.

Speaking to journalists on Monday after the second day of the District Commissioner Conference at Osmani Memorial Auditorium, Dr. Ahmed stated that District Commissioners (DCs) had reported significant earnings among rural professionals, many of whom evade taxation. To address this, the National Board of Revenue (NBR) will take initiatives to identify such individuals, with DCs compiling lists of high-earning doctors, lawyers, and businesspeople. The government aims to increase tax collection and expand revenue without imposing additional burdens.

He explained that many businesspersons generate considerable sales, and doctors and lawyers charge substantial fees. However, their income often goes unreported. The government plans to enforce tax collection by ensuring transactions occur through digital payment methods or receipts. This approach will improve accountability and tax compliance.

Dr. Ahmed noted that DCs themselves had highlighted the significant earnings of rural businesspersons, prompting NBR to initiate a tax enforcement drive. Expanding the tax net is essential, as demands persist for reducing VAT and tax rates. Instead of increasing tax rates forcibly, the strategy is to widen the tax base, making taxation more inclusive and sustainable. He revealed that although the country has around 5 to 6 million industrial entities, only about 500,000 pay taxes, highlighting the need for reform.

The Finance Advisor also addressed the issue of direct cash transactions by doctors and lawyers, which often prevents tax collection. Since most patients do not receive receipts for medical fees, these earnings remain undocumented. Implementing digital payments would create a record of transactions, similar to practices in other countries. He suggested that medical attendants who collect fees should provide receipts to ensure tax compliance. Similar measures will be introduced for lawyers and other professionals.

Dr. Ahmed further emphasized the importance of boosting employment opportunities at the local level. He pointed out how rural industries in China are deeply connected to global markets, with products from remote villages being sold in major retailers like Walmart in the United States. In contrast, Bangladeshi rural industries struggle due to inadequate communication networks, hindering balanced economic development.

He reiterated that government policies are executed by field-level officials, and their efficiency determines the effectiveness of public services. If grassroots officials are competent and service-oriented, citizens receive the intended benefits. Strengthening field-level administration will therefore be crucial in ensuring the success of the government's tax and revenue expansion initiatives.

repoter