ছবি: Photo: Collected

Bangladesh's garment industry has shown resilience, maintaining steady export growth despite significant challenges stemming from political upheaval and labor unrest. Between July and December 2024, the country exported apparel worth $19.88 billion, a 13.28% increase compared to $17.56 billion during the same period the previous fiscal year.

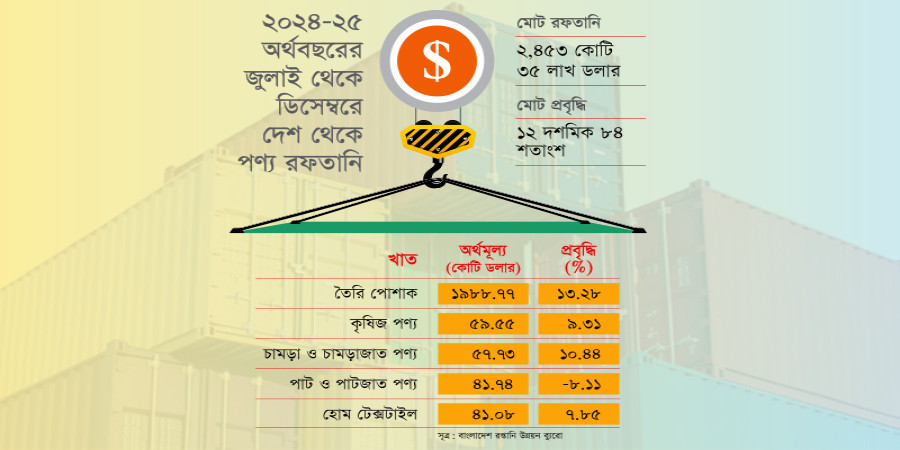

The Export Promotion Bureau (EPB), based on data from the National Board of Revenue (NBR), revealed these figures in its latest report. In the first half of FY 2024-25, total exports from Bangladesh amounted to $24.53 billion, with garments contributing the lion’s share at 81%.

The industry faced significant disruptions starting in July 2024, when anti-discrimination protests escalated, impacting production in garment factories across industrial hubs. The situation intensified in August after the fall of the Sheikh Hasina government, leading to recurring labor unrest in manufacturing zones. Despite these challenges, both entrepreneurs and workers sustained production and exports.

Industry stakeholders attribute the continued growth to shifting global dynamics, particularly tensions between China and the United States. Buyers, wary of potential disruptions, have increasingly redirected orders from China to Bangladesh. This trend has presented both opportunities and challenges for the country’s garment exporters, who are grappling with capacity constraints to meet the surge in demand.

The Managing Director of DBL Group, MA Jabbar, noted that their company saw a 12% growth compared to the previous year despite disruptions. He attributed this to a strong order book, geopolitical advantages, and the “China Plus One” sourcing strategy, which encourages diversification of supply chains beyond China.

H&M, one of Bangladesh's largest apparel buyers, echoed similar sentiments. According to Country Manager Ziaur Rahman, the redirection of orders from China has significantly benefited Bangladesh, making it one of their primary sourcing markets.

The export sector's performance varied across products. Leather and leather goods exports grew by 10.44%, while agricultural products saw a 9.31% increase. Home textiles experienced a 7.85% rise, but jute and jute goods exports fell by 8.11%.

In December alone, Bangladesh exported goods worth $4.63 billion, marking a 17.72% growth from the same month in 2023. Of this, apparel accounted for $3.77 billion, with woven garments contributing $1.88 billion and knitwear $1.89 billion.

Despite these positive figures, industry leaders are cautious about the future. Political instability and ongoing labor disputes pose risks to long-term stability and growth. The Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) President Mohammad Hatem acknowledged the challenges but credited the industry's resilience and collaboration with government agencies like the NBR for sustaining growth.

Ashulia, a major industrial hub, has been particularly affected by labor unrest over the past six months. Efforts to address these issues have included forming a platform led by Bangladesh Garment Manufacturers and Exporters Association (BGMEA) member Enamul Haque Khan Bablu. According to Bablu, while unrest impacted about 5% of factories, the remaining 95% continued operations, benefiting from the influx of orders diverted from China.

BGMEA’s former Senior Vice-President Abdullah Hil Rakib emphasized the need for government support to ensure sustained growth. He highlighted the importance of addressing wage-related disputes and maintaining political stability to retain buyers’ confidence.

The industry’s current growth is largely attributed to geopolitical factors, including shifts in U.S.-China trade relations. However, stakeholders warn that without strategic investments in production capacity and product diversification, Bangladesh risks losing its competitive edge.

As buyers increasingly view Bangladesh as a stable alternative to China, industry leaders stress the importance of long-term planning and collaboration between the government and private sector to capitalize on emerging opportunities and address potential challenges.

repoter