ছবি: Photo: Collected

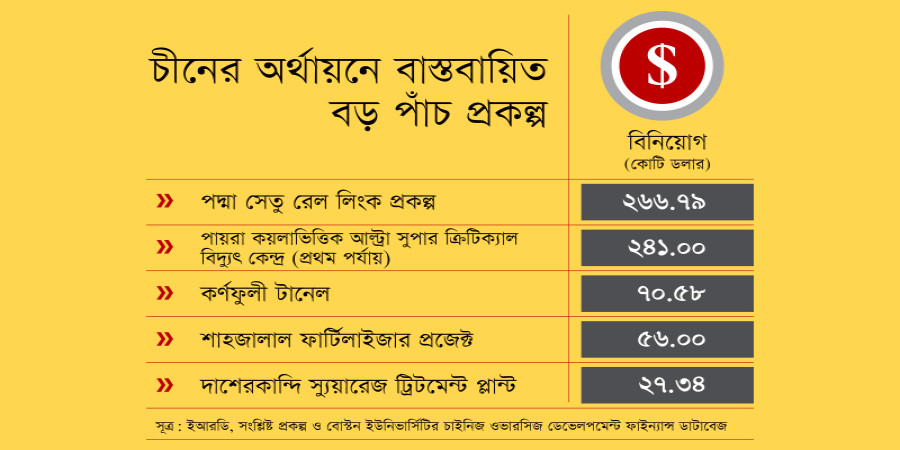

In the past 15 years, Bangladesh has implemented numerous large-scale infrastructure projects funded by China. These include significant endeavors like the Padma Bridge Rail Link and the Payra Ultra Super Critical Power Plant. However, these projects, which were initially presented as financial and developmental boons, are now proving to be a heavy burden on the national economy. Despite promises of economic growth and job creation, many of these projects are struggling to generate enough revenue to cover operational and maintenance costs. Worse still, the repayments for the massive loans taken to fund these projects are draining the state’s coffers.

The financial agreements surrounding these projects were promoted with the expectation that they would yield substantial returns. The Padma Bridge Rail Link project, for example, is among the most expensive, with a total cost of BDT 39,246 crore. Of this, BDT 21,036 crore is funded by a Chinese loan. Despite its high potential, the project has yet to deliver the promised financial returns. Although the rail link began limited operations in November 2023, the revenue from just three intercity and two mail trains has been far below expectations, amounting to only BDT 36.71 crore in the first six months. This has made it difficult to cover the expenses of the project, let alone repay the loans, forcing the government to provide subsidies.

Experts suggest that the lack of economic success in these projects is primarily due to inadequate planning and an overestimation of their financial viability. Dr. Shamsul Haque, a professor at Bangladesh University of Engineering and Technology (BUET), points out that while these projects were sold to the public as catalysts for economic activity and decentralization, the actual results have been disappointing. The Padma Bridge, for instance, was supposed to spur industrialization and reduce congestion in Dhaka, but the anticipated benefits have yet to materialize. Instead of easing the pressure on the capital, the bridge has led to an influx of people into Dhaka, increasing its congestion.

One of the most problematic projects is the Payra Ultra Super Critical Power Plant, built with Chinese financing. Since its completion, the plant has faced a range of operational challenges. Among the biggest hurdles has been the difficulty in importing fuel due to navigational issues in the Payra River. Despite a large investment of BDT 24,100 crore, the plant’s production costs are rising, and the facility has faced periods of inactivity due to fuel shortages. The project’s financial strain has worsened due to the depreciation of the local currency, making it increasingly difficult to pay off its substantial loans.

Similarly, the Karnaphuli Tunnel, another China-backed infrastructure project, is also running at a loss. With a total cost of BDT 10,689 crore, the project’s revenue in its first year of operation, which began in October 2023, amounted to just BDT 37 crore, while its annual maintenance costs exceed BDT 136 crore. The tunnel’s financial challenges stem largely from the slow pace of other planned development projects in the southern region of Chittagong, which were supposed to drive traffic through the tunnel. As a result, the toll revenue has been far below projections, and the government will need to subsidize its upkeep and loan repayment.

The underperformance of these projects has raised questions about the role of political considerations in their approval. Some critics argue that many of these large-scale initiatives were pushed forward not solely for their economic benefits but also for political reasons, with promises made to garner public support. Dr. Moinul Islam, a former professor of economics at Chittagong University, has expressed concerns that these projects were pursued not on the basis of solid economic planning but rather to facilitate corruption and the diversion of funds. He believes that the lack of proper feasibility studies and realistic projections has resulted in massive debts with no tangible returns.

The government's reliance on Chinese financing has also come under scrutiny, with former diplomats and economists questioning the long-term consequences of these projects. According to former ambassador M. Humayun Kabir, the political motives behind these projects often took precedence over the genuine need for such investments. The challenge now, he warns, is that Bangladesh has already entered a "debt trap" due to these costly ventures, and without significant returns, the country will struggle to meet its financial obligations in the future.

With economic returns failing to match expectations, many of these China-funded projects have become a significant financial burden for Bangladesh. Experts are urging the government to reassess the viability of such large-scale investments and focus more on projects that will deliver sustainable economic growth, rather than relying on politically motivated infrastructure projects that offer little in terms of tangible benefits.

repoter