ছবি: Photo: Collected

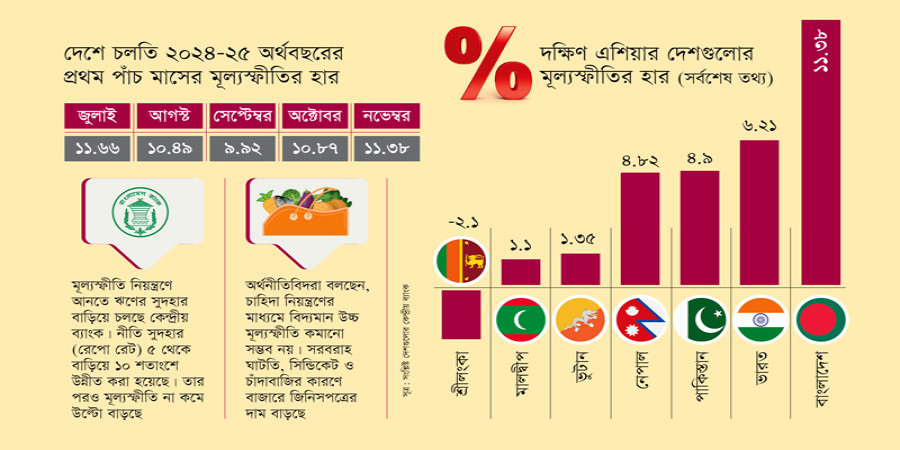

In the wake of an economic crisis that led to the downfall of President Gotabaya Rajapaksa's government two years ago, Sri Lanka has seen a remarkable shift in its economic situation. Facing severe economic collapse, with inflation soaring to nearly 70% at the time and a complete lack of foreign currency reserves, Sri Lanka was in a dire situation. However, since September, Sri Lanka has experienced a negative inflation rate for the first time in months, reflecting a decline in the prices of goods and services. In November, the country posted an inflation rate of -2.10%, showing a significant improvement in its economic conditions.

Similarly, despite enduring political instability, Pakistan's economic recovery has been notable this year. The country's inflation rate in November stood at 4.90%, the lowest in over six years. This marked a stark contrast to the inflation rate of 38% in April of the previous year, highlighting the positive turn in the country's economic trajectory.

However, in stark contrast to these neighboring nations, Bangladesh continues to grapple with a rapidly rising inflation rate. According to the Bangladesh Bureau of Statistics (BBS), the inflation rate for the country in November reached 11.38%, an increase from 10.87% in October. Food inflation alone surged to around 14%. This marks a continuation of Bangladesh's trend of high inflation, which now stands as the highest in South Asia.

The country's inflation issues are further compounded by political unrest. After mass protests, Prime Minister Sheikh Hasina fled the country on August 5, and many of her political associates followed suit. During this period of upheaval, many hoped that the market would see a reduction in price gouging and that goods would become more affordable. However, despite the disappearance of well-known market manipulators, prices have not decreased; instead, the market has become more unstable, and inflation has continued to rise.

Bangladesh's central bank has been trying to combat the rising inflation with contractionary monetary policies. The repo rate, which is the interest rate charged by the central bank for lending to commercial banks, was increased from 5% to 10%. Similarly, interest rates on bank loans have risen sharply, with some rates exceeding 15%. The aim was to control demand and reduce inflationary pressures. However, these measures have not yielded the expected results, and inflation remains high.

Economists suggest that the root causes of Bangladesh's persistent inflation are supply shortages and poor market management. Merely controlling demand through monetary tightening will not resolve the inflation issue. To reduce inflation, there needs to be an increase in production and imports, which will help stabilize the supply of goods in the market. Without such steps, the economic situation could worsen in the coming months.

Dr. Fahmida Khatun, Executive Director of the private research organization Centre for Policy Dialogue (CPD), explains that the ongoing inflation is a result of supply shortages. She believes that the government needs to take swift action to restore normalcy in supply chains. While the central bank has raised interest rates to curb demand, Khatun warns that further hikes may not be effective. She also notes that although previous corrupt market players have fled, new ones have emerged. The government's failure to break up market cartels and control the syndicates remains a major obstacle to stabilizing the market.

The CPD Executive Director emphasizes that without immediate intervention to resolve supply issues and break market monopolies, the government will struggle to control inflation. Additionally, the government's decision to waive or reduce duties on essential goods has not yet had any noticeable impact on the market, as the country continues to face supply shortages.

Inflation has been a persistent issue in Bangladesh for almost three years, with the average inflation rate exceeding 9% in the last two fiscal years. In July 2024, the inflation rate was recorded at 11.66%. Following the fall of the Sheikh Hasina government in August, inflation slightly decreased to 10.49% in that month. September saw a further reduction to 9.92%. However, inflation surged again in October and November, reaching 11.38%.

The BBS also reported that food inflation in November was particularly high, at 13.80%. Non-food inflation stood at 9.39%, compared to 12.66% and 9.34%, respectively, in October. The situation was similar in rural areas, where the inflation rate in November was recorded at 11.53%, up from 11.26% in October. The rural food inflation rate stood at 13.41%, while non-food inflation was 9.72%. In comparison, the inflation rate in urban areas was 11.37%, up from 10.44% in October. Urban food inflation in November was 14.63%, while non-food inflation stood at 9.31%.

This surge in inflation is a significant concern for Bangladesh, which now has the highest inflation rate in South Asia. Among other South Asian economies such as India, Pakistan, Sri Lanka, Maldives, Nepal, and Bhutan, Bangladesh’s inflation stands as the highest. Sri Lanka, which was once in an economic crisis, now has the lowest inflation rate in the region, with a negative inflation rate of -2.10% in November. The Maldives follows with an inflation rate of 1.1%, while Bhutan and Nepal report rates of 1.35% and 4.82%, respectively. Pakistan's inflation rate stands at 4.90%, and India’s inflation rate is 6.21%.

Economists like Dr. Mustafa K. Mujeri, Executive Director of the Institute for Inclusive Finance and Development, believe that controlling inflation through demand-side measures alone is not sufficient. He suggests that the government needs to address the supply-side issues, such as improving the supply chain and tackling the market monopolies. According to Mujeri, despite efforts to reduce duties on essential goods, these measures have not helped due to the gaps in the market. He also calls on the government to investigate the market manipulators who are continuing to exploit the system.

Dr. Mohammad Habibur Rahman, Deputy Governor of Bangladesh Bank, echoes these sentiments, stating that the central bank has already taken all possible measures to control inflation, including raising interest rates. However, he acknowledges that the real issue lies in the inadequate supply of goods in the market, which is preventing prices from falling. He stresses that effective measures to increase supply are essential to controlling inflation and improving the economic situation.

In conclusion, while neighboring countries like Sri Lanka and Pakistan have made significant progress in tackling inflation, Bangladesh continues to struggle with rising prices. The government faces significant challenges in addressing the root causes of inflation, such as supply shortages and market inefficiencies. Without effective intervention in these areas, the inflation crisis may continue to escalate in the coming months.

repoter