ছবি: Photo: Collected

In 2016, hackers orchestrated one of the world’s largest cyber thefts, stealing $81 million from Bangladesh Bank’s account at the Federal Reserve Bank of New York. The stolen funds were transferred to the Rizal Commercial Banking Corporation (RCBC) in the Philippines and laundered through local casinos. While $15 million was later recovered and returned to Bangladesh, $66.4 million remains untraced.

Bangladesh Bank discovered the heist on February 5, 2016, a day after it occurred, but kept it confidential. The incident was disclosed to the finance minister 33 days later and became public 39 days after the theft. Following public outrage, a case was filed on March 15, 2016, by Zobayer Bin Huda, Deputy Director of Bangladesh Bank's Accounts and Budgeting Department, at Motijheel police station. The charges included money laundering, fraud, and criminal breach of trust.

Despite these accusations being under the jurisdiction of the Anti-Corruption Commission (ACC), the Criminal Investigation Department (CID) of the police was given the case, raising questions about the investigation's legitimacy. According to legal experts, crimes related to the heist fall under ACC's purview as per Bangladesh's Anti-Corruption Commission Act of 2004. Nevertheless, CID undertook the investigation and identified 13 individuals from Bangladesh Bank, including then-Governor Atiur Rahman, as complicit in the theft.

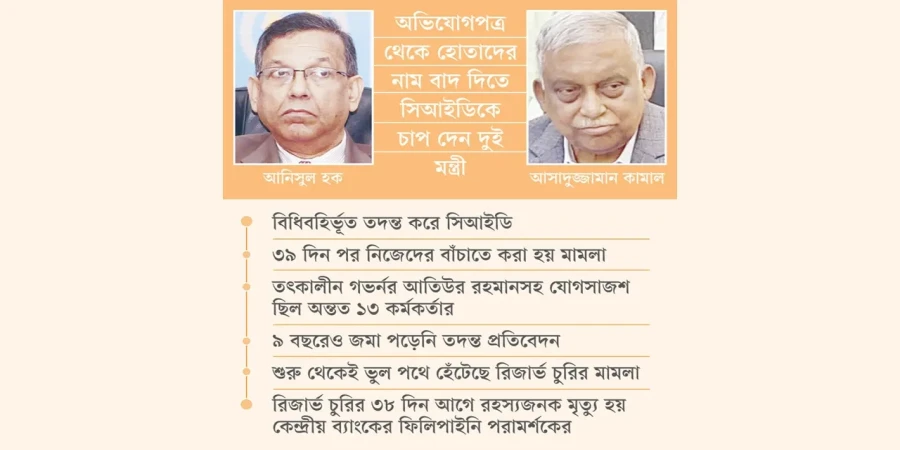

By October 2020, CID claimed to have gathered substantial evidence from Bangladesh, the Philippines, and India, implicating several suspects. However, the formal charge sheet has yet to be filed. Sources revealed that the delay was influenced by political interference. Allegedly, two influential ministers from the ruling Awami League government—Home Minister Asaduzzaman Khan and Law Minister Anisul Huq—pressured CID to exclude the names of certain central bank officials from the report. Despite resistance from investigating officers, the ministers reportedly held multiple meetings with senior CID officials, attempting to alter the findings.

In one heated meeting, the former Home Minister allegedly reprimanded CID officers for their refusal to omit names from the charge sheet. Later, critical forensic evidence was reportedly taken to the central bank and accessed by the accused officials. This led to further delays and obstructions in the investigation.

Among the implicated individuals were Atiur Rahman, one executive director, one general manager, three deputy directors, four joint directors, and three deputy general managers. Some of these officials have since retired, while others were promoted to senior positions.

Adding to the mystery is the death of Edison Jovellanos, a Filipino consultant for Bangladesh Bank, who was found dead in Manila just 38 days before the reserve heist. Jovellanos had been working under a World Bank-funded project aimed at strengthening the central bank. His death, initially reported by the Philippine company managing the project, was categorized as "top secret" by Bangladesh Bank officials and never publicly disclosed. Jovellanos is suspected of having knowledge of the heist, making his death a potential link to the case.

The software systems used by Bangladesh Bank during the heist also came under scrutiny. In 2009, the bank signed contracts with Spanish firm Indra Sistemas and its Philippine subsidiary, Indra Philippines, to implement ERP and data warehouse systems. Jovellanos served as the project manager. Investigators suspect lapses in cybersecurity and system integrity facilitated the theft.

Despite CID’s significant findings, questions remain about why the investigation was not transferred to the ACC. Legal provisions designate the ACC as the only authority permitted to investigate such offenses, as public servants implicated in crimes like breach of trust and misconduct fall under its jurisdiction. Critics argue that the government deliberately bypassed the ACC to exert influence over the investigation.

Since the regime change in Bangladesh, the ACC has reportedly resumed interest in the case. The agency’s intelligence wing has begun collecting evidence and has already uncovered critical information. ACC officials have also discussed the matter with the current governor of Bangladesh Bank, Ahsan H. Mansur.

An ACC official remarked, “The ACC has the expertise and legal authority to investigate such cases. Handing over the investigation to another agency not only undermines the legal process but delays justice. Evidence deteriorates over time, which benefits the culprits. This appears to be a calculated effort to protect those involved.”

The prolonged delay and alleged political manipulation in the case have fueled public skepticism about Bangladesh’s commitment to holding those responsible accountable. Meanwhile, the stolen reserves remain a stark reminder of vulnerabilities in financial systems and the challenges of ensuring transparency and justice in high-profile cases.

repoter