ছবি: Photo: Collected

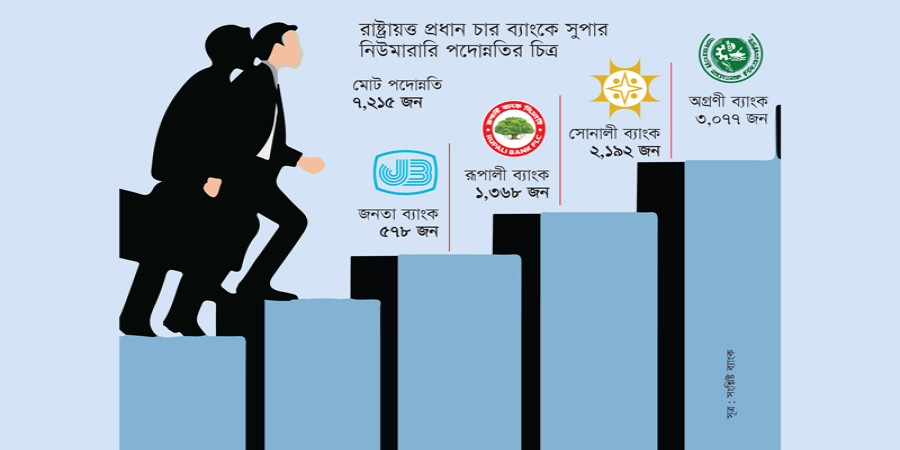

The state-owned banks in Bangladesh have witnessed an unprecedented surge in officer promotions, with nearly 10,000 officers being elevated in positions, despite the absence of official vacancies. This mass promotion was carried out in four major state-owned banks following the interim government's takeover after a popular uprising. Of these, 7,215 officers were promoted on a "Supernumerary" basis, a term used when positions are created without regard to the bank's organizational structure or available vacancies.

Historically, this kind of mass promotion has never occurred in the state-owned banks. The banks involved include Sonali, Janata, Agrani, and Rupali, all of which have granted these promotions without the typical vacancies being present. The promotions were not limited to a few select individuals; rather, they span across key executive positions such as Deputy General Manager (DGM), Assistant General Manager (AGM), Senior Principal Officer (SPO), Principal Officer (PO), and Senior Officer (SO). This unprecedented move has raised concerns about further deterioration in the banks' internal discipline and governance.

Among those promoted, a total of 1,067 officers were moved from Senior Principal Officer to Assistant General Manager, marking a significant advancement in their careers. AGMs, who receive higher pay, enhanced benefits, and a personal vehicle loan, are entitled to 30 lakh BDT in interest-free loans for purchasing a vehicle, along with monthly allowances for maintenance. However, due to the sheer number of officers being promoted, state-owned banks are now struggling to accommodate these personnel, with limited office space and additional resources becoming increasingly stretched.

These promotions come at a time when the state-owned banks are facing some of the most challenging conditions in their history. A significant portion of their loan portfolios, about 50%, has turned non-performing. With capital and provision shortages, these banks are barely surviving under their government labels. The accumulated bad loans have reached around 1.5 lakh crore BDT, a heavy burden on the financial system. In light of these challenges, the total expenditure for the promotions could amount to almost 1,000 crore BDT.

The first incident of mass promotions occurred at Sonali Bank, the largest state-owned bank, where 2,192 officers were promoted on a Supernumerary basis on December 23. In response to staff pressure, the bank's management promoted 433 officers from SPO to AGM. This was followed by Agrani Bank, which, under pressure from its officers, promoted a record 3,077 individuals. This included promotions from SPO to AGM and PO to SPO. These two banks have now set a precedent, and the trend continued in January, when Rupali Bank and Janata Bank also promoted a total of 1,368 and 578 officers, respectively, on the same basis.

This surge in promotions has also led to a ripple effect in other state-owned banks. Officers at Basic Bank, a bank that has faced financial turmoil since 2009, are now demanding similar promotions. Basic Bank, which has suffered from significant financial losses and a high proportion of non-performing loans, is yet to recover despite receiving large capital injections from the government. Similarly, officers at other specialized state-owned banks, such as Bangladesh Agricultural Bank (BKB) and Rajshahi Krishi Unnayan Bank (RAKUB), are now pushing for Supernumerary promotions, citing the examples set by their peers in the major commercial banks.

While the promotional efforts are justified by some as a necessary measure to uplift officers who have been waiting for years without advancement, others argue that this practice may only exacerbate the already unstable situation. The promotions have raised issues regarding favoritism and corruption, especially in banks like Rupali, where there are allegations of improper conduct, including bribery and nepotism. Officers who were not considered "eligible" are reportedly being promoted due to personal connections and financial transactions with senior executives. This has led to widespread dissatisfaction among employees, further damaging the trust in the system.

A senior official from one state-owned bank, speaking on condition of anonymity, stated that while the intent behind the promotions may have been to boost morale among officers who were stagnating in their positions, the process has backfired. It has disrupted the hierarchy within the banks, with many qualified and capable officers now feeling sidelined, while unqualified individuals have moved up the ranks. This erosion of internal discipline, the official warns, will likely lead to long-term organizational instability, further jeopardizing the banks' already fragile performance.

Despite these concerns, some bank officials, such as Sonali Bank’s Chairman, Mohammad Muslim Chowdhury, have defended the mass promotions. He explained that many officers were promoted after being stuck in the same position for years, which led to frustration and a lack of motivation. The decision to promote on a Supernumerary basis, he argued, was intended to provide a fresh impetus to the workforce, allowing officers to take on more responsibility and contribute to the bank's recovery.

The broader impact of these promotions is also being felt in Bangladesh’s banking sector. As of June 2024, there were approximately 208,000 employees across the country's banking industry, with over 49,000 working in the six state-owned commercial banks. Given that nearly 10,000 officers have received promotions in just a few weeks, the figures underscore the scale of the changes taking place. The country’s banking sector is already under significant stress, with many institutions struggling with high levels of bad debt and liquidity shortages.

The mass promotion strategy has not been without its critics. Experts suggest that such large-scale promotions are unsustainable, especially in a sector already struggling with severe financial difficulties. The question remains whether the banks, already reeling from bad loans and financial mismanagement, can afford the added burden of these promotions. Without significant reforms and strategic improvements, many fear that the path taken by these banks may lead to a deeper crisis, undermining the future stability of the financial system.

In conclusion, while the mass promotion of officers in Bangladesh's state-owned banks may have been intended as a quick fix to address staff dissatisfaction and performance stagnation, it has created new challenges. The banking sector’s already precarious position is now further complicated by a lack of clear organizational structure, rising operational costs, and a growing sense of instability.

repoter