ছবি: Photo: Collected

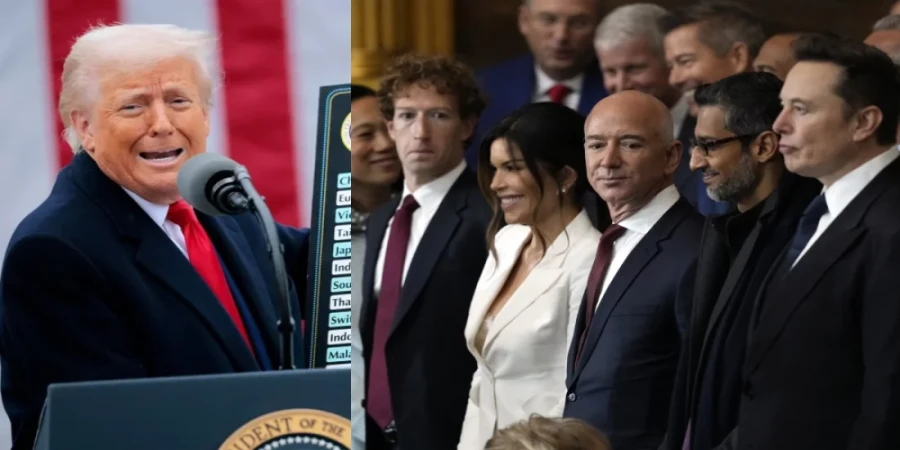

In a dramatic blow to the global financial landscape, a single policy announcement from former U.S. President Donald Trump triggered a staggering $208 billion plunge in the combined wealth of the world’s 500 richest individuals. This sharp decline, reported by Bloomberg on Friday, April 4, comes as a direct consequence of Trump's newly announced retaliatory tariffs—sending shockwaves through markets and leaving even his closest allies financially bruised.

The fallout, which unfolded within just 24 hours of Trump's declaration, marks the fourth-largest single-day drop ever recorded in the Bloomberg Billionaires Index since its inception 13 years ago. Notably, it stands as the worst decline since the economic upheavals during the COVID-19 pandemic, underscoring the immense volatility that the global economy continues to face in response to geopolitical tensions.

Among the hardest hit are prominent American billionaires, many of whom have lost billions in personal net worth. The most notable among them is Facebook and Meta founder Mark Zuckerberg, whose wealth plummeted by $17.9 billion—approximately 9% of his total fortune. Amazon’s Jeff Bezos followed closely, losing $15.9 billion, while Tesla and SpaceX CEO Elon Musk, a known confidant of Trump, suffered a loss of $11 billion. Despite his ties to the former president, Musk could not escape the financial backlash.

Other significant losses include French luxury tycoon Bernard Arnault, who saw $6 billion shaved off his fortune, as well as tech leaders like Michael Dell, who lost $9.53 billion, and Oracle co-founder Larry Ellison, who saw an $8.1 billion dip. Jensen Huang of Nvidia lost $7.36 billion, while Google co-founders Larry Page and Sergey Brin lost $4.79 billion and $4.46 billion respectively. Veteran investor Thomas Peterffy also witnessed a $4.06 billion decline.

Bloomberg’s index showed that over half of the tracked billionaires saw a drop in their net worth, with the average decline hovering around 3.3%. These losses reflect more than just temporary market jitters—they reveal the broader economic uncertainty that looms over global markets amid trade policy tensions and shifting power dynamics.

Analysts point to Trump’s tariff announcement as a direct catalyst for the market slump, reigniting fears of a trade war and disrupting investor confidence. This has resulted in a massive sell-off across global stock markets, particularly in sectors where billionaires are heavily invested, such as tech, retail, and luxury goods.

NDTV further reported that the majority of the 500 affected billionaires were based in the United States, highlighting the particular vulnerability of American wealth to sudden policy shifts. The disproportionate impact on U.S.-based fortunes also raises questions about market resilience and the fragility of even the most expansive financial empires.

As markets continue to assess the long-term implications of Trump's tariff measures, Friday's historic wealth erosion stands as a stark reminder of how political rhetoric and economic policy can instantaneously reshape the fortunes of the world’s elite.

repoter