ছবি: সংগৃহীত ছবি

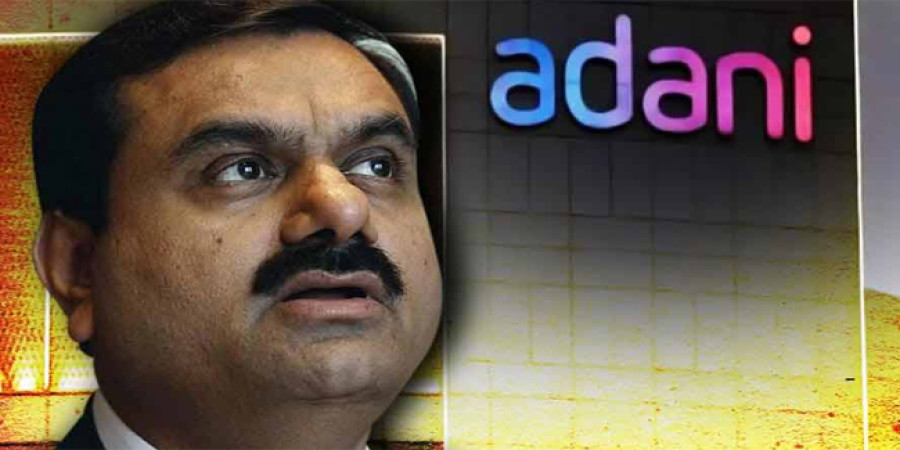

The Adani Group, led by Indian industrialist Gautam Adani, is once again facing a crisis after its shares dropped significantly, following corruption and financial fraud allegations made against him and his associates. The accusations emerged after it was revealed that Adani and others allegedly attempted to bribe Indian government officials to secure a solar power project contract worth 200 million dollars over 20 years.

According to a notification issued by the U.S. Attorney's Office for the Eastern District of New York, Adani Group executives, including Gautam Adani, offered nearly 23.37 billion rupees in bribes to officials involved in the solar energy project. This led to immediate controversy and a sharp decline in Adani Group stocks on the market.

On Thursday, the stock prices of Adani Group companies plummeted, with Adani Enterprises seeing a 10% drop, reaching ₹2,539.35. Adani Green Energy's stock dropped by 17%, reaching ₹1,172.50, while Adani Energy Solutions faced the largest fall, with its shares losing 20%, dropping to ₹697.25.

As the corruption allegations against Gautam Adani and his associates gained traction, Adani Group's shares continued to fall sharply. In just one hour, the group lost ₹2 trillion in value on the Indian stock market.

The bribery scandal also involves Gautam's brother, Sagar Adani. According to reports, arrest warrants have been issued against both Gautam and Sagar Adani by U.S. authorities. Other accused individuals include CEO of Adani Green Energy Limited, Vineet Jain, Ranjit Gupta, Rupesh Agarwal, Australian and French nationals Cyril Cabannes, Sourabh Agarwal, and Deepak Malhotra.

A spokesperson for the Adani Group confirmed that a statement addressing the allegations will be released soon.

This latest controversy comes after the 2022 Hindenburg report, which accused the Adani Group of stock manipulation. Following the report, Adani Group's stock prices crashed, causing a significant drop in the market value of its companies. The group's market capitalization, which was once ₹19 trillion, plummeted by ₹7 trillion, leaving it at around ₹12.5 trillion. Despite efforts to recover over the past year, Adani's empire has now faced another significant blow.

repoter